AI-Powered Stock Sentiment Analysis from Reddit

Track real-time sentiment of stocks mentioned across Reddit's financial communities with advanced AI analysis. Make smarter investment decisions with data-driven insights.

Powerful Features for Smart Investors

StockHark combines cutting-edge AI with real-time data to give you the edge in stock market analysis

AI Sentiment Analysis

Advanced FinBERT AI model analyzes thousands of Reddit posts to determine true market sentiment with precision accuracy.

Real-Time Monitoring

Live tracking of stock mentions across major financial subreddits including r/wallstreetbets, r/stocks, and r/investing.

Trend Detection

Identify trending stocks before they explode. Our algorithms detect emerging patterns and sentiment shifts early.

Smart Alerts

Get instant email notifications when significant sentiment changes occur for stocks you're watching.

Reliable & Secure

Enterprise-grade infrastructure ensures your data is safe and service is available 24/7 with 99.9% uptime.

Community Insights

Tap into the collective wisdom of Reddit's millions of traders and investors for comprehensive market insights.

About StockHark

StockHark is a sophisticated real-time sentiment analysis platform that monitors Reddit's financial communities 24/7. We leverage state-of-the-art AI technology to analyze thousands of posts and comments, extracting valuable sentiment data that helps investors make informed decisions.

Our platform processes mentions from top financial subreddits like r/wallstreetbets, r/stocks, r/investing, and more, applying advanced natural language processing to deliver actionable insights through an intuitive dashboard.

Built with reliability and accuracy in mind, StockHark uses FinBERT, a specialized financial sentiment model, combined with sophisticated aggregation algorithms to ensure the most accurate sentiment scores in the industry.

Powerful Features at Your Fingertips

Discover how StockHark transforms Reddit sentiment into actionable investment insights

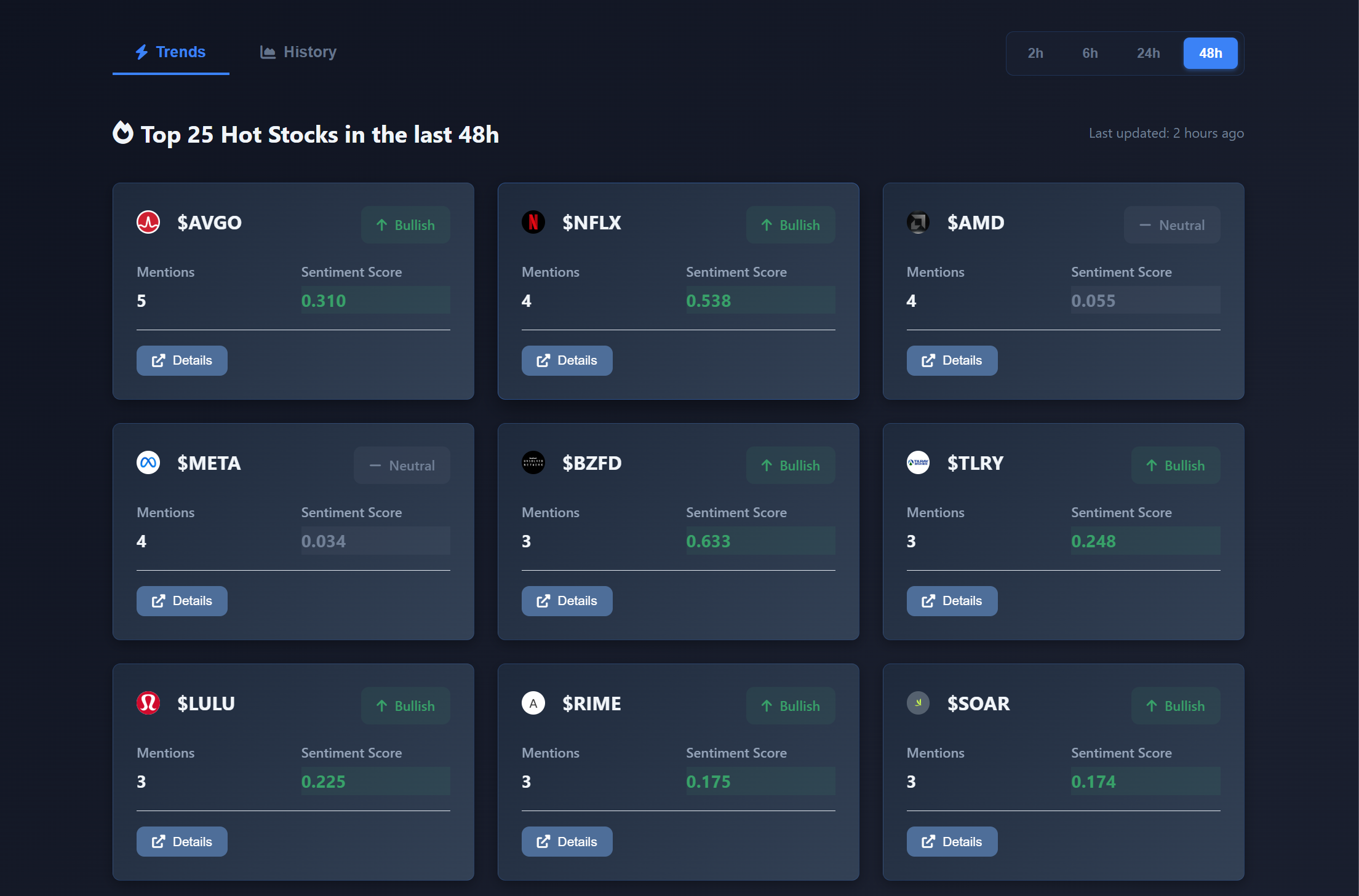

Interactive Stock Dashboard

Monitor trending stocks with our beautifully designed, real-time dashboard. Each stock card provides at-a-glance insights into market sentiment, helping you spot opportunities before they go mainstream.

Key Features:

- Real-time Mention Tracking: See how many times each stock is discussed across Reddit's financial communities

- AI Sentiment Scores: Instant bullish, bearish, or neutral classification with confidence levels

- Time-Based Filtering: View data for 2h, 6h, 24h, or 48h windows to match your trading strategy

- Detailed Stock Views: Click any stock for comprehensive metrics, price charts, and source analysis

Perfect for: Day traders monitoring short-term sentiment shifts and long-term investors tracking sustained interest

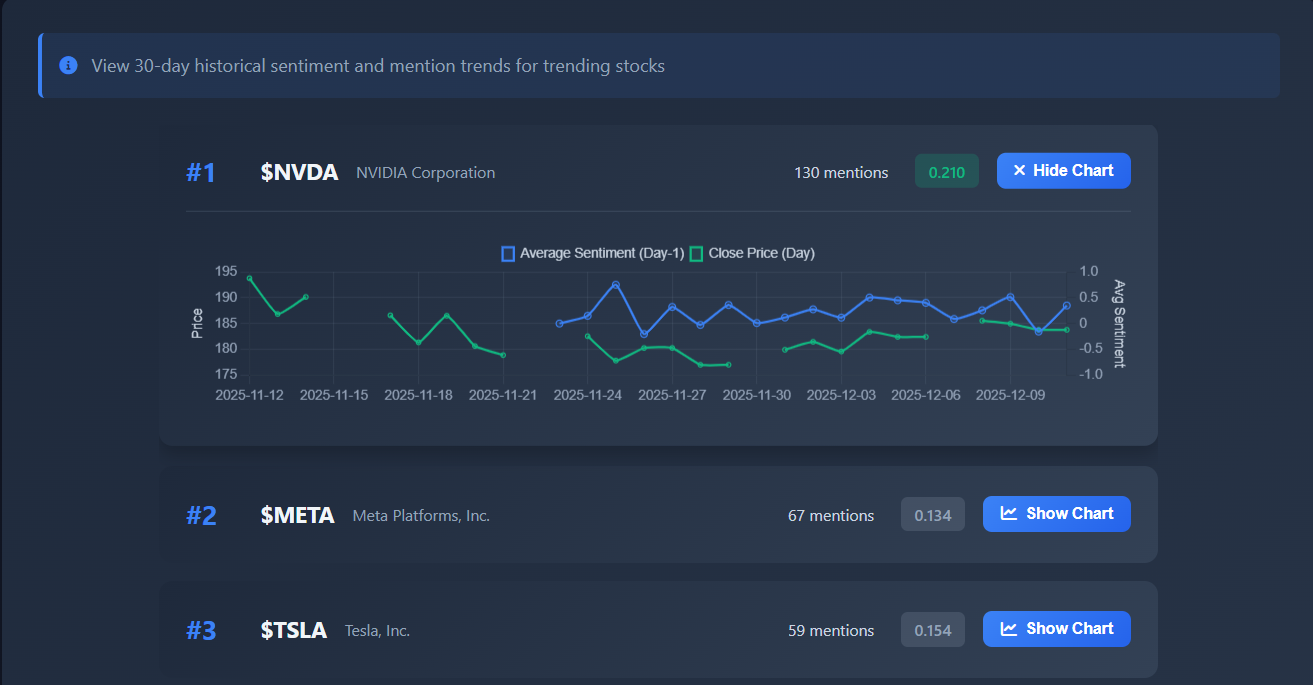

Historical Trend Analysis

Track sentiment evolution over time with our advanced historical charting system. Understand how market perception changes and identify patterns that precede major price movements.

What You Get:

- 30-Day Historical View: Visualize mention volume and sentiment trends across a full month

- Sentiment Momentum: Identify when stocks transition from bearish to bullish (or vice versa)

- Volume Spikes: Detect unusual activity that often precedes significant price action

- Multi-Stock Comparison: Compare sentiment trends across multiple stocks simultaneously

Use Case: Spot early warnings when sentiment diverges from price action, indicating potential reversals or continuation patterns

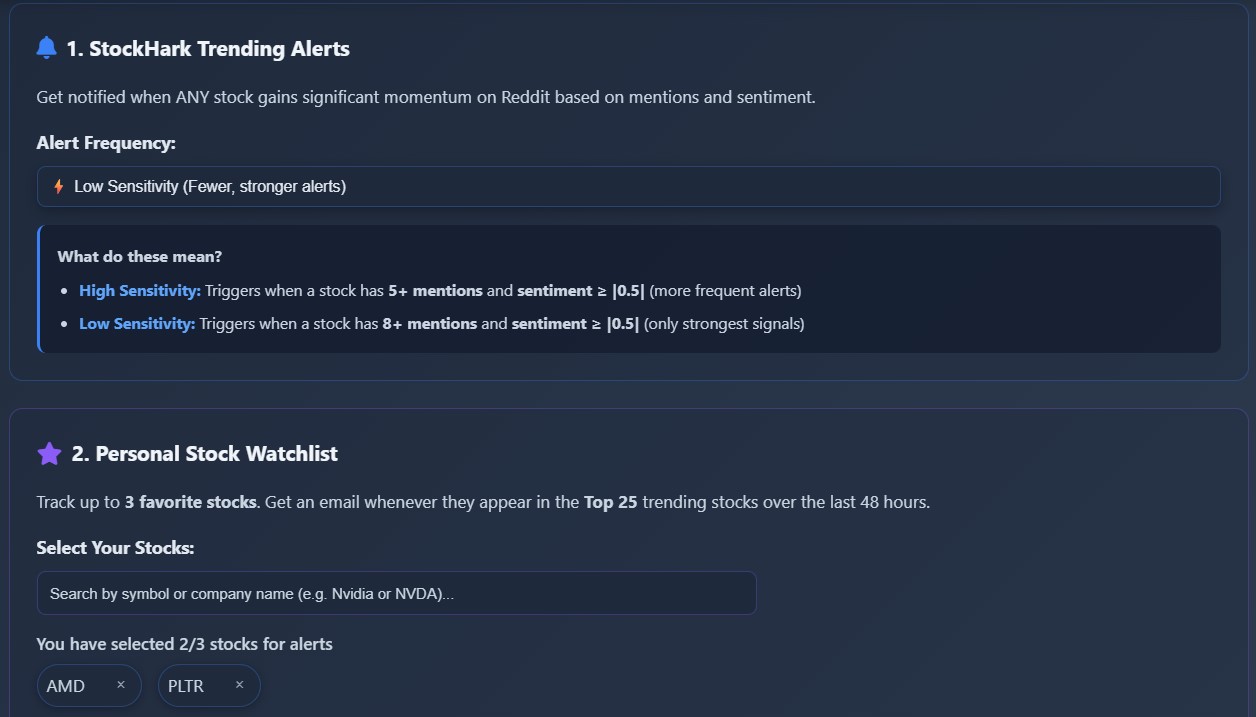

Smart Alert System

Never miss important market movements with our intelligent, customizable alert system. Get notified when stocks you're tracking meet your specific criteria—delivered straight to your inbox.

How It Works:

- Personalized Watchlists: Create custom alert profiles for stocks you care about

- Flexible Thresholds: Set minimum mention counts and sentiment levels that trigger alerts

- Email Notifications: Receive professionally formatted emails with comprehensive stock analysis

- Customizable Frequency: Choose how often you want updates (hourly, daily, or real-time)

Spam Protection

Built-in cooldown periods prevent alert fatigue while ensuring you never miss critical movements

Sentiment Breakdown

Each alert includes bullish/bearish/neutral distribution with confidence scores

Top Sources

See which subreddits are driving the conversation for each alerted stock

Manage Anywhere

One-click unsubscribe links and easy preference management from any device

Perfect For: Busy traders who can't monitor Reddit 24/7 but want to catch momentum before it peaks

How Our Sentiment Analysis Works

A sophisticated 5-stage pipeline combining AI, temporal intelligence, and advanced weighting

Stage 1: FinBERT AI Analysis

We use FinBERT, a specialized transformer model trained on 1.8 million financial communications. Unlike general language models, FinBERT understands market-specific context—distinguishing between "bearish rally" and "bullish sentiment" with 94%+ accuracy. Every Reddit mention is analyzed to produce three probabilities:

P(positive) + P(neutral) + P(negative) = 1.0

Raw Sentiment = P(positive) - P(negative)

We also implement a composite fallback system—if FinBERT is unavailable, rule-based analyzers seamlessly take over, maintaining 85%+ accuracy through financial lexicon matching.

Stage 2: Temporal Intelligence

Market sentiment evolves rapidly. Our exponential time decay system ensures recent mentions carry significantly more weight:

wt = e-0.1 × hours_ago

A mention from 12 hours ago receives only 30% of the weight of a current mention. Posts older than 24 hours drop to just 9% influence. This captures intraday market movements and breaking news impact while preserving context.

Stage 3: Multi-Factor Weighting

Volume Amplification: Stocks with more discussion get logarithmic boosts. A stock with 5 posts gets +32% weight, 20 posts get +60%, while 100+ posts cap at +192%. This prevents single mentions from dominating while rewarding genuine community interest.

Source Reliability: Different subreddits carry different weights based on discussion quality and signal-to-noise ratio. Posts from r/investing and r/stocks receive baseline weight (1.0), while others are adjusted based on historical reliability.

Symbol Filtering: Common English words that double as tickers (CAN, GO, ON) receive reduced weight (0.7) to minimize false positives, while clear stock symbols (AAPL, TSLA, MSFT) receive full weight.

Stage 4: Dual Sentiment Aggregation

We provide two distinct metrics:

Raw Sentiment: Simple arithmetic average of all sentiment scores—baseline comparison without weighting factors.

Aggregated Sentiment: Our sophisticated weighted average incorporating temporal decay, volume amplification, and reliability factors. This is what you see on stock cards and what drives our rankings.

Aggregated = Σ(score × wtime × wvolume × wsource) / Σ(weights)

Example: If a stock has 3 mentions—one recent (+0.85 bullish, 2h ago), one older (-0.70 bearish, 8h ago), and one moderate (+0.65 bullish, 5h ago)—the raw average is +0.27, but the aggregated sentiment is +0.42 because recent bullish sentiment carries more weight.

Stage 5: Smart Caching & Real-Time Queries

We use a dual-query strategy for optimal performance: pre-aggregated 48h cache for instant dashboard loads, and real-time time-filtered queries for 2h/6h/24h windows. This ensures both speed and surgical accuracy—you get millisecond response times without sacrificing data precision.

Why This Matters:

Our methodology doesn't just count mentions—it understands context, prioritizes recency, amplifies consensus, and filters noise. The result? Sentiment scores that actually correlate with market movements, giving you an edge when seconds matter.

Meet the Team

We're a group of developers from Austria who got hooked on the idea of making sense of Reddit's stock chatter.

What started as a side project fueled by curiosity, late-night coding sessions and interesting conversations with LLMs turned into StockHark.

No corporate backing, no fancy office—just genuine passion for building something useful. We believe good tools

shouldn't be locked behind institutional walls, so we're putting everything we've got into making sentiment

analysis accessible to everyone.

Built with dedication, powered by coffee, and driven by the simple goal of creating something we'd want to use ourselves.

Ready to Make Smarter Investment Decisions?

Join StockHark today and get instant access to AI-powered sentiment analysis